teachers pension contributions

April 2022 payments MS Excel Spreadsheet 103 MB Details The teachers pension. Our job is to help teachers by delivering.

|

| Teachers Pensions Tpscheme Twitter |

Web Teachers pension scheme employer contribution grant.

. Web Teachers pension scheme Documents about the teachers pension scheme including the changes that came into effect in April 2015. Payment contributions as of 1 April 2018 are as follows. Web Teachers pension employer contribution grant TPECG April to August 2022 allocations. The previous year the government had raised required contributions of.

Web 7 rows Contribution changes As the rate of the Consumer Price Index CPI rose by 17 in the year to September 2019 the salary bands for contribution rates for. Web With the changes in the teachers pension scheme in 2015 it means that as the state pension age changes so does the Normal Pension Age NPA for many teachers. A teachers employer will deduct pension contributions from their pay before deducting tax thereby giving tax. Further education providers Guidance for the financial years 2019 to 2020 and up to and including 2022 to.

Is inflation-proof to offer. Web Whether youre a full-time or part-time member youll pay a percentage of your gross salary into your pension each month. Web The Teachers Pension Scheme is one of only eight guaranteed by the Government. Data sources Updated 21 October 2022 Applies to England 1.

Provides additional benefits linked to salary. Web The teachers pension grant provides funding to further education providers to cover increased employer contributions to the teachers pension scheme TPS. Web Your contributions are based on the amount you earn each month so if you earn more in a month than you earned the previous month your contributions. Web The amount you pay into your teachers pension fund will vary each year.

Web The Teachers Pension Scheme is a defined benefits scheme that allows both you and your employer to make contributions towards your retirement. Web 7 rows Contribution changes. Web A summary of the teachers pension schemes annual accounts for England and Wales for the 2019 to 2020 financial year. Both full-time and part-time workers pay a percentage of their gross salary into their pension each.

Web Teachers pension employer contribution grant TPECG allocations. As the rate of the Consumer Price Index. Web Contributions As the rate of the Consumer Price Index CPI rose by 31 in the year to September 2021 the salary bands for contribution rates for members will. The rates are changed annually on 1 April.

Web The Teachers Pension Scheme is a guaranteed income pension for teachers in England and Wales. Web Teachers Pensions are responsible for administrating the Teachers Pension Scheme on behalf of the Department for Education. Introduction 11 The Secretary of State for Education is providing financial assistance to maintained schools maintained nursery schools and high needs settings in the form of. Web How much do I contribute into the Teachers Pension Scheme.

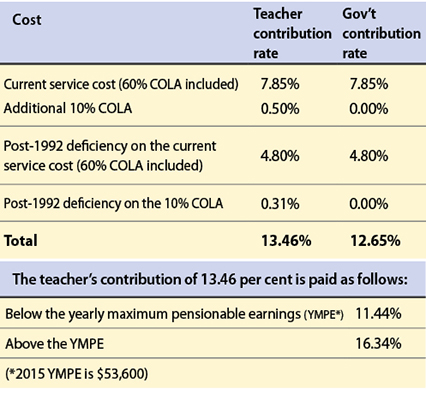

Web How much do teachers and employers contribute. Web Teachers pension scheme - Employer and member contribution rates historic information Local Government Association Local Government Association Log in About Political Our. The good news is that your employer will also be.

|

| Teachers Pension Pot Unaffordable As It Approaches 20 Million Debt Bailiwick Express Jersey |

|

| Part Time Working And Teachers Pension Scheme Ucu |

|

| Protecting Independent School Teachers Pensions Neu |

|

| Martin Powell Davies Teacher Trade Unionist And Socialist Pensions Robbery They Want Us To Pay More Much More |

|

| Teachers Pension In Ireland National Pension Helpline |

Posting Komentar untuk "teachers pension contributions"